Subscribe now and get the latest podcast releases delivered straight to your inbox.

Additional federal coronavirus (COVID-19) relief your business should know about

By John Becker

Apr 10, 2020

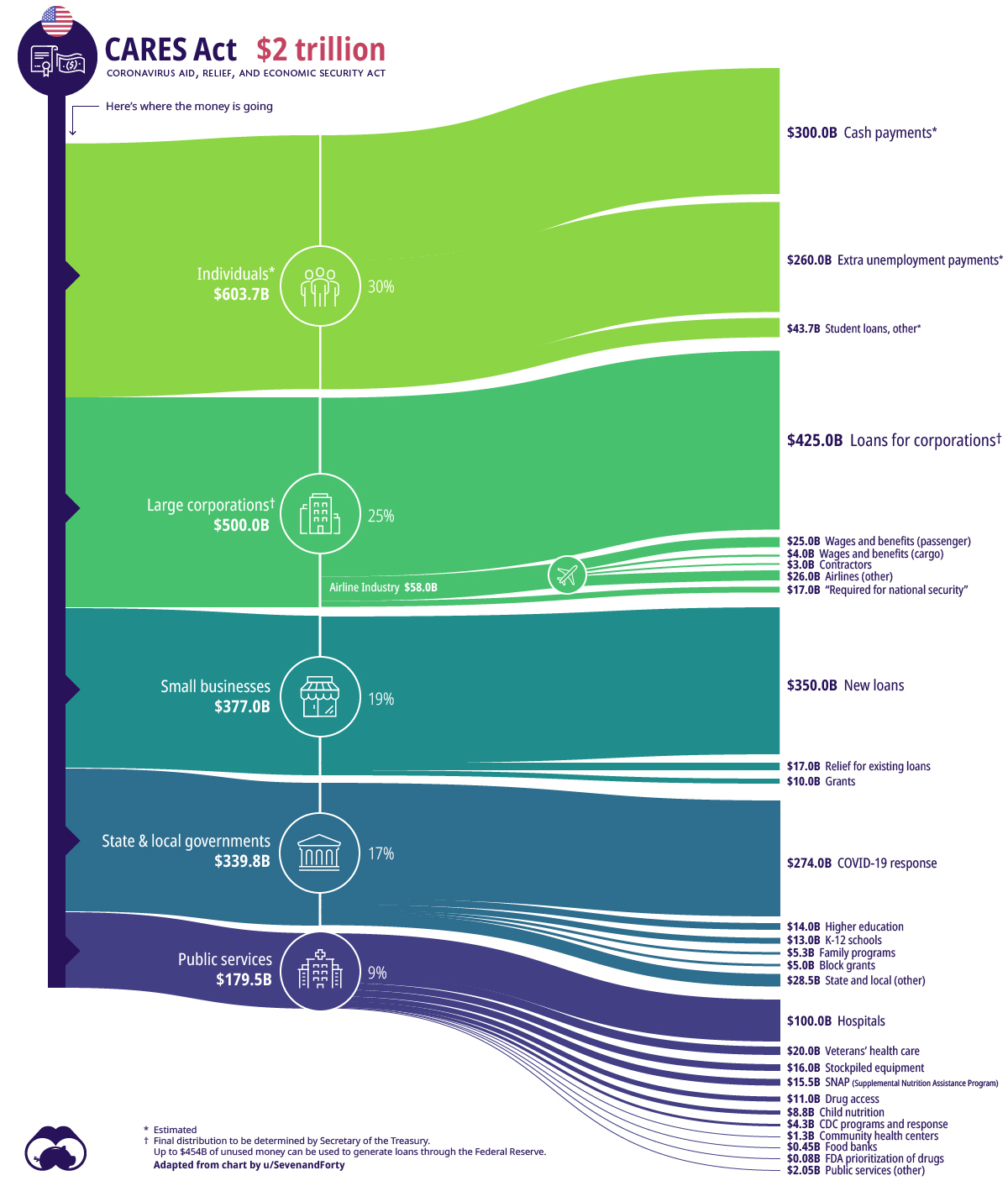

The federal government’s Coronavirus Aid, Relief, and Economic Security Act (or CARES) seeks to shore up the US economy in the face of its unprecedented and abrupt shutdown.

The CARES Act allocates $2 trillion in federal aid, making it the largest relief legislation in history.

🔎 Related: View all of our related coronavirus coverage and resources

For a visual representation of where that money is going to go, check out this infographic from Visual Capitalist:

As you can see, a full $377 billion will go to small businesses (officially designated as those with fewer than 500 employees).

Much attention has been paid to the Paycheck Protection Plan, which at $350 billion, accounts for the lion’s share of the allotment. Despite how big that number sounds, lawmakers are already discussing diverting additional funds to help even more small businesses.

(for help with the PPP, check out our article explaining how and when you can apply)

However, in addition to the PPP, $27 billion more has been set aside to assist SMBs as well. Here's what you need to know about these other funds.

Debt relief for new and existing loans

Many SMBs get loans through lenders associated with the US Small Business Association (SBA). Now, the SBA is preparing to relieve some of the pressure for small business borrowers.

Automatically, the SBA will pay the principal, interest, and fees of existing 7(a), 504, and microloans for six months. At the time time, the SBA will pay principal, interest, and fees for new loans issued prior to September 27, 2020, according to the agency’s website.

The SBA is also providing automatic (but optional) deferments to home and business disaster loans through December 31st. Although the loan amount will still need to be repaid, interest will not accrue during this time.

If you have questions about your SBA loan, contact your lender or the SBA Disaster Loan Servicing Center directly.

SBA express bridge loans

If your business already has a banking relationship with an SBA lender, you may be eligible for an express bridge loan that will allow you to quickly access up to $25,000.

(Click here for a full list of SBA lenders)

An express loan is designed to offer near-immediate assistance to struggling businesses who are applying for other relief.

Application information can be found here.

EIDL grants

In addition to the PPP, debt relief, and bridge loans, the SBA is also offering loan advance grants for up to $10,000 for quick cash flow. This will come by way of an Economic Injury Disaster Loan — and the loan advance will not need to be repaid.

EIDLs provide support for businesses suffering from a temporary loss of revenue due to the coronavirus pandemic.

Businesses can apply on the SBA website portal (or with their SBA lender), and the advance should come quickly. According to the SBA website, “the Economic Injury Disaster Loan advance funds will be made available within days of a successful application.”

Looking ahead

As you evaluate these assistance programs for your business, remember two additional pieces of information:

- Be sure to check with your state. Your state government is likely to have an array of relief options available as well. Check your state government’s website to see what’s available.

- Assistance programs are not just for SMBs. In most cases, relief programs are not limited to traditional for-profit businesses. Private non-profits, cooperatives, independent contractors, veteran organizations, faith-based organizations, and self-employed workers can apply as well.

In behooves all SMBs to talk with their lenders and financial professionals to know what assistance programs they might qualify for.

With vast, but limited, resources available, the early and well-informed applicant will be in the best position.

Order Your Copy of Marcus Sheridan's New Book — Endless Customers!