Topics:

Marketing StrategySubscribe now and get the latest podcast releases delivered straight to your inbox.

Paycheck Protection Program application and required documents (CARES Act)

By Bob Ruffolo

Apr 1, 2020

It has now been nearly a week since the Coronavirus Aid, Relief, and Economic Security Act – or "CARES Act" — was signed, setting into motion the largest stimulus package in U.S. history.

While the bill allots historic levels of resources for businesses, everyday citizens, and those who become unemployed, experts believe that the funding will not cover all of the economic losses from the coronavirus (COVID-19) epidemic.

Earlier this week, we recapped what this bill means for small businesses, how to know if your business qualifies for the Paycheck Protection Program, and how you should plan to take advantage of it.

🔎 Related: View all of our coronavirus resources for businesses

It is crucial that you know exactly what’s being offered, how to apply, and what sort of timeline to expect — even as some details are yet to be rolled out.

If you plan to apply for the Paycheck Protection Program, you need to get started right away

It appears that loans will be given on a first-come, first-served basis. We’re also hearing that if all qualified businesses apply for the loan, there may only be enough to cover 30% of them.

That means if you plan to take advantage of this program, you need to get all of your ducks in a row now and move fast. You’ll want to be first in line with your bank.

The $349 billion authorized for the PPP comes from the federal government but will be distributed by SBA lenders. Therefore, your application will go through your SBA lender.

If you don’t have a lender, look here to find one near you.

Which documents should you be preparing right now for your PPP application?

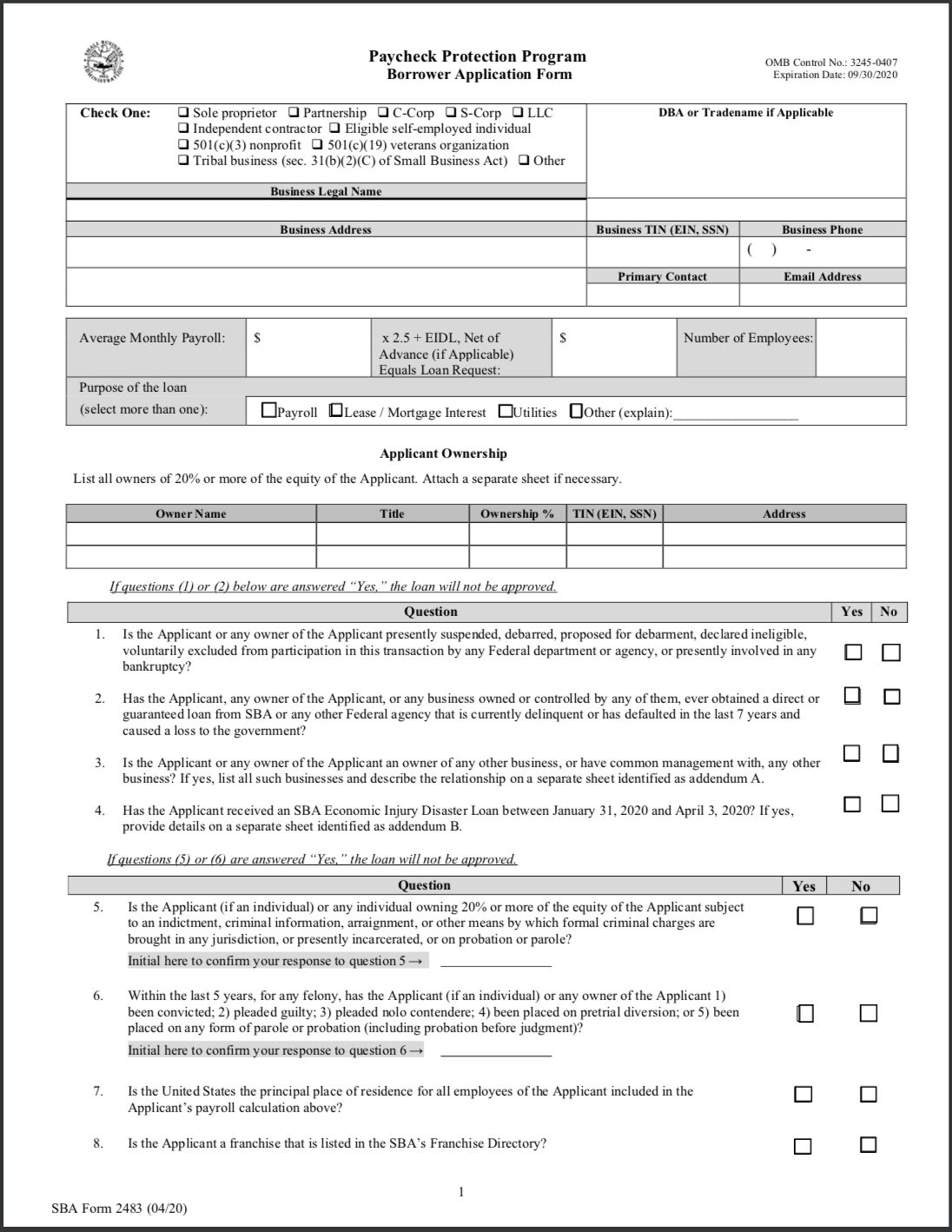

For starters, take a look at the application:

DOWNLOAD PAYCHECK PROTECTION PROGRAM APPLICATION

In addition to your completed application, you should have the following documents and information available and ready to review with your banker:

- Articles of incorporation for each borrowing entity

- By-laws or operating agreement for each borrowing entity

- Copies of each owner's driver's license

- Payroll expense verification documents

- IRS forms 940 and 941

- Payroll summary report with corresponding bank statements

- Breakdown of payroll benefits (vacation, allowance for dismissal, group healthcare benefits, retirement benefits, etc.)

- 1099s (if you are an independent contractor)

- Certification that all employees live within the United States

- If any do not, provide a detailed list with corresponding salaries

- Trailing twelve-month profit and loss statement (as of the date of application) for all applicants

- Most recent mortgage or rent statement

- Most recent utility bills

(This list is courtesy of our friends over at Petra Coach.)

Getting these documents together today — and getting them to your lender — will assure that your application will be handled as quickly as possible.

What is the application timeline for the Paycheck Protection Program?

According to the U.S. Treasury, small businesses and sole proprietorships can apply starting on April 3, 2020. Independent contractors and those who are self-employed can start applying on April 10.

Both of these dates refer to applications going through current SBA lending financial institutions. Other regulated lenders will be able to make loans as well — as soon as they are approved and enrolled in the PPP.

The Paycheck Protection Program will be available through June 30, 2020.

What are the next steps for SMBs?

The PPP offers businesses a lifeline during this turbulent time. Every business affected by COVID should speak to their lender, legal counsel, and financial professionals as soon as possible.

Business leaders should begin assembling the necessary paperwork so there are no impediments once the application process opens.

You’ll want your application to be on the top of the pile.

While the PPP is the centerpiece of the stimulus bill’s relief for small businesses, there are other programs rolling out as well.

There are Economic Injury Disaster Loans (EIDL), which also offer small business grants of up to $10,000 that do not need to be repaid. Find out more and apply here.

There are also SBA debt-relief programs and bridge loans available.

Additionally, states are offering their own assistance programs. In Connecticut, for example, Governor Lamont has also created the Connecticut Recovery Bridge Loan Program, which can provide emergency cash flow to businesses and non-profits with fewer than 100 employees. For details, check out this website help center.

For businesses to survive and prosper during this unprecedented time, leaders need to avail themselves of every resource that’s out there.

Careful planning today can make sure your business is poised to move smoothly through the crisis.

How should SMBs focus their digital sales and marketing strategies through this pandemic?

World-renowned speaker, best-selling author of They Ask, You Answer, and IMPACT partner Marcus Sheridan urges all small and mid-sized businesses to keep the following key points in mind, before making any drastic changes to their strategies:

- Your competitors are going to strip down content marketing to next to nothing, creating a giant opportunity for you to gain search rankings and mindshare. Plus, more than ever, your sales team is going to need more tools in their toolbox.

- The marketplace in every industry is going to be looking for leaders. You can not risk your competition coming in and owning the conversation.

- "Because of pain, we’re going to be forced to do things we’ve never done before, which leads to unique innovations.” We must say, “We’re going to figure this out because it’s the only choice we have.”

- If your sales team is not already using one-to-one personalized video, like Vidyard GoVideo, to stand out from all those boring, soulless emails. NOW is the time to make this a priority. Here is our getting started guide for video for sales.

- If you do not have a virtual sales process yet, you must make this a priority. We can't assume that our sales team knows what to do now that they're working virtually.

Marcus is diving deep into these topics during his opening workshop at Digital Sales & Marketing Day (virtual conference) on Monday, April 6, at 9 a.m. eastern. You can also read more on this thoughts on digital sales and marketing in the age of coronavirus here.

Our best resources for businesses pivoting during the coronavirus pandemic

- From our CEO: Now is the time for excellence, perspectives on a pandemic

- From Marcus Sheridan: Content marketing in the wake of coronavirus

- Your strategy: How to prioritize and pivot your content strategy amid chaos

- For sales: How to empower a face-to-face sales team to embrace virtual selling

- Why video: Why this pandemic makes video more important than ever

How IMPACT virtual strategy services and workshops can help your company survive and thrive

From changing the way you communicate with customers to how to deliver your services, shifting to a virtual way of doing business can be daunting. IMPACT can teach you the proven strategies and expert guidance your company needs to thrive in any economic climate:

- Digital Selling Workshop

- Video for Sales Training

- Virtual Event Consulting

- Strategic Consulting

- Fast-Start Program for Inbound

Or, if you have general questions or just want to talk about your most pressing digital sales and marketing challenges during these uncertain times, let's set up a time to talk.

Order Your Copy of Marcus Sheridan's New Book — Endless Customers!